Today, the business sector is observing an increase in the activity of private investments. Specifically, the US PE Breakdown report for 2023 indicates that the PE (Private Equity) cluster is ready to restore its volumes in 2024. However, for such a trend to be realized, investors need a new approach to investment analysis. This also includes a new format for conducting due diligence.

As the trend toward increased private equity investment continues, companies should take special care about the efficiency of conducting high-quality due diligence. This process will help to avoid unwanted fraud, manipulation of transactions, or the creation of inefficient partnerships.

This request is especially high in the private equity sector, where clients want to use only effective private equity due diligence software tools to perform comprehensive analysis. Therefore, we propose to take a closer look at the format of due diligence under the prism of private investments, exploring unprecedented approaches to conducting economic factor analysis as well as models.

Integrating AI and Big Data in Private Equity Analysis

Some business representatives still wonder, “What is private equity due diligence?”. It is a comprehensive procedure for examining and evaluating the financial, legal, operational, and strategic aspects of a business. It’s like a thorough investment evaluation performed by investors before proceeding with further financial operations.

The overall concept of due diligence is focused on making a well-considered, strategically successful investment decision with quality control. In the realm of private equity analysis, comprehensive legal review plays a particularly decisive role, as it helps to minimize risks while simultaneously increasing value for investors themselves.

Previously, this process relied on the human factor of information analysis (manual component) and was time-consuming. The modern approach to due diligence is focused on:

- Multi-sectoral analysis: from reviewing indicators of cybersecurity, financial, and legal metrics to the environmental and social dimensions of the business.

- Incorporation of automated tools for big data analytics, including artificial intelligence, cybersecurity tools, and other innovative technologies.

- In-depth analysis of various aspects: from news publications about business activities to social media and other sources of business visibility in the media to form a comprehensive understanding.

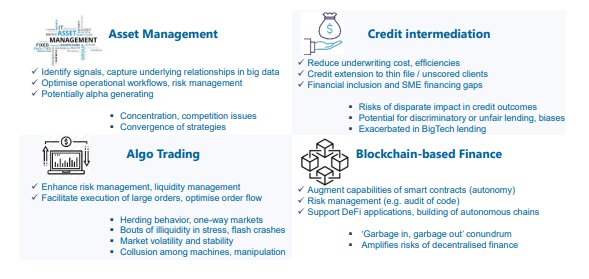

In particular, the use of AI in due diligence demonstrates a notable result. In general, artificial intelligence has a powerful impact on the business models of the financial sector, as shown in the infographic.

This technology has transformed into an irreplaceable tool for the automated processing of all collected information about a company to form a broad map of the business. Documents, reports, statistics – all require careful evaluation.

Therefore, the capabilities of artificial intelligence allow delegating the execution of this task not only to a team of specialists but also to an automated software system. This way, investors can more quickly identify potential risks in their decisions to avoid unpleasant situations.

Cost-Effective Models in Due Diligence Software

When it comes to comprehensive due diligence, investors are willing to pay for the most accurate analytics, rather than relying on “intuition”. However, usually for budget considerations, clients prefer software that offers more features for a lower price.

Overall, the pricing policy of an effective due diligence model depends on many aspects: starting from the size and complexity of the business structure to the volume of documentation and the deadlines for execution. Each software solution model typically offers a classic set of due diligence tools with additional unique propositions from the provider. Among such software solutions, it’s worth mentioning:

- Analytics using Artificial Intelligence (AI) and Machine Learning (ML);

- Natural Language Processing (NLP);

- Integration of blockchain technology for documentation;

- Automated risk detection tools;

- Use of Robotic Process Automation (RPA) and more.

In light of these factors, cost-effective due diligence requires a preliminary decision from investors regarding what expenses they can afford. Clients objectively determine the scope and areas of analysis, set priorities, and establish clear questions for which they wish to receive answers as a result.

Unconventional Approaches Yielding Success

The private equity due diligence process has already become a standard tool for business investors. It allows for the assessment of factors important to the client, using a convenient set of tools and the technical capabilities of software. However, despite the fact that leading case studies discuss standard and more classical methods of conducting due diligence, this process could be more varied.

Each potential client-company can use modern software to create a unique experience and develop unconventional approaches for unexpected results. Here are a few interesting cases:

- Centralized management. The Crosslink Capital firm actively used a comprehensive software solution to consolidate investor data in one space that would be convenient and accessible, with the ability to dynamically update. However, at the beginning, the company was confused about how to store data on subsidiaries and smaller divisions.

- Investing in real estate. Investor and real estate agent Justin Pierce noted: “The buyer is at an informational disadvantage.” He thinks that it is impossible to know more about a property than the seller, especially when it comes to problematic aspects. Therefore, Pierce emphasizes due diligence in dealing with such issues.

The case of the founding of New Private Equity remains intriguing. The representatives decided to look at software from a different angle and created their own end-to-end workflow process based on software to facilitate interaction. Such a decision will contribute to the prompt decision-making based on thorough data analysis. This is, indeed, the goal of modern data management software.

Summary

Over the years, the cluster of strategic investments has required thorough preliminary research before making a decision. Given the ever-increasing amount of information, investors aimed to find a new approach to analysis and strategic planning.

A solution to this is due diligence on private equity funds. This comprehensive approach involves assessing the operational model, analyzing the organizational structure, and potentially limiting risky moments, having a transformative impact on business conduct.

In practice, due diligence demonstrates its usefulness, as this method is used by private investors in various industries. Moreover, this concept aptly responds to current changes in client requests and new technological capabilities.