The multi-faceted world of business trade should be seen as a complex instrument where due diligence investigation takes a central role. The due diligence serves to detail any ambiguities in all the involved parties, leaving no room for errors through investigation. Submitting to the upsurge in consumer protection, business owners who want to foresee the future are advised to understand the details of due diligence.

What is Due Diligence Investigation?

Business due diligence is employed in up to 90% of M&A transactions as the most important practice in the business world, therefore, this process is very thorough and goes beyond the financial assessment looking closely at the organization’s legal position, efficiency of its operations and other assorted issues is extremely important.

Overview

As a key, a thorough investigation is conducted with the intent of assuring the viability of the investment or partnership. It is a procedure of thorough analysis of the candidate’s finances, laws, and practices to discover the risk factors that can influence the decision-making performance.

Types of Due Diligence

The scope of due diligence can vary significantly depending on the nature of the transaction. It generally encompasses several key areas:

- Financial Due Diligence. This crucial pillar of due diligence delves into the financial health of the business in question, dissecting past financial statements and forecasting future performance. It aims to validate the financial information presented, uncovering any discrepancies.

- Legal Due Diligence. Navigating the legal landscape, this type assesses the legal risks attached to the business, scrutinizing contracts, ongoing or potential litigations, and ensuring compliance with relevant laws and regulations.

- Operational Due Diligence. It examines the operational workflows, supply chain management, and technological infrastructure to ensure the business’s operational model is robust and sustainable.

In essence, due diligence investigation is not just a precautionary step but a strategic tool that illuminates the path to successful business ventures. By offering a 360-degree view of the target entity, it empowers investors and business owners to make informed decisions.

The Scope of Due Diligence Investigations

By all means, due diligence must be conducted in the case of the deals in the sphere of business. The first step is to look at the pros and cons of the business, check the financial stability, make sure everything is legal, and look into the business operation and the market position of the business. We can have a better clear picture of the company’s finances by diving into all the details. This will give us stability and growth prospects.

Compliance with the law is more or less the last thing and nothing pretty to see in this case. The operational checks which will figure out if the business can execute what it promised is one of the crucial steps. On the other hand, the competition’s position is also crucial to know if your business can be competitive. All those components together guide us in choosing the most appropriate ways of bypassing the risks and using opportunities.

How to Conduct a Due Diligence Investigation

The scenario of completing a dual diligence investigation is aking to putting together a complicated puzzle in which all the pieces represent the important features and may reveal a possible investment or partnership. This highly structured manner which is meant for discovering the truth in the numbers, legal documents, and operating indicators is the process. Let’s get to the core of the problem: how to effectively deal with it!

Preparing for the Investigation

In any due diligence investigation, the first step is the most important part of the whole process which is all about getting ready. You summon a group of experts – financial analysts, legal lawyers, and sector specialists. They’ll all take on a diverse area of that company you’re looking at. Moreover, you have to persuade the court that there is something in your case that requires investigation.

It is your task to outline what matters to you most, say in this case, thoroughness of their financials, adherence to the law, how well they are doing business and ordinary as well as potential competitors. Therefore, it is a phase when we have to understand what this process is about.

Key Steps in the Process

Once the team is in place and the investigation’s objectives are crystal clear, we dive into the core phases of the due diligence process. Each step, from gathering data to validating its accuracy, is crucial for a comprehensive understanding of the target company.

- Data Collection.

- Analysis.

- Verification.

Each of these steps, from preparation to verification, forms a critical part of the due diligence process, guiding investigators through a structured approach.

Utilizing Technology and Tools

AI analytics takes data processing in the flesh provides data insights, and blockchain makes the data record reliable and secure. Such tools make the data collection and analysis process uncomplicated and quicker, and they boost accuracy. In essence, such technology deployment implies the research is of a high standard and is being performed using the most advanced stools available.

Due Diligence Investigation Report

A diligence report ensures a comprehensive understanding of the facts around the investment before the decision-making. It is systematical and systematically reports the data about financial health, legal compliance, operational efficiency of the company, and market positioning of the subject. The report normally gives an executive summary for a quick look, an in-depth analysis of each investigated area, and recommendations that suggest what to do based on the findings.

Components of the Report

In crafting a succinct due diligence investigation report, the document synthesizes critical insights into the target company’s operations, financial stability, legal standing, and market position, designed to inform strategic decision-making. Here’s a due diligence investigation report example example:

- Executive Summary.

- Financial Analysis.

- Legal Assessment.

- Operational Review.

- Risk Assessment.

- Conclusion and Recommendations.

- Appendices.

This format ensures that stakeholders receive a clear, comprehensive view of the potential investment, facilitating informed decisions grounded in thorough analysis.

Interpreting the Findings

Interpreting a due diligence report demands understanding how different factors, like financial health, legal risks, and market position, affect a target’s value and risks. Stakeholders need to balance these elements, along with insights into management quality and market potential, to inform a robust investment strategy. Consulting with experts across various fields often provides the comprehensive insight needed for sound decision-making.

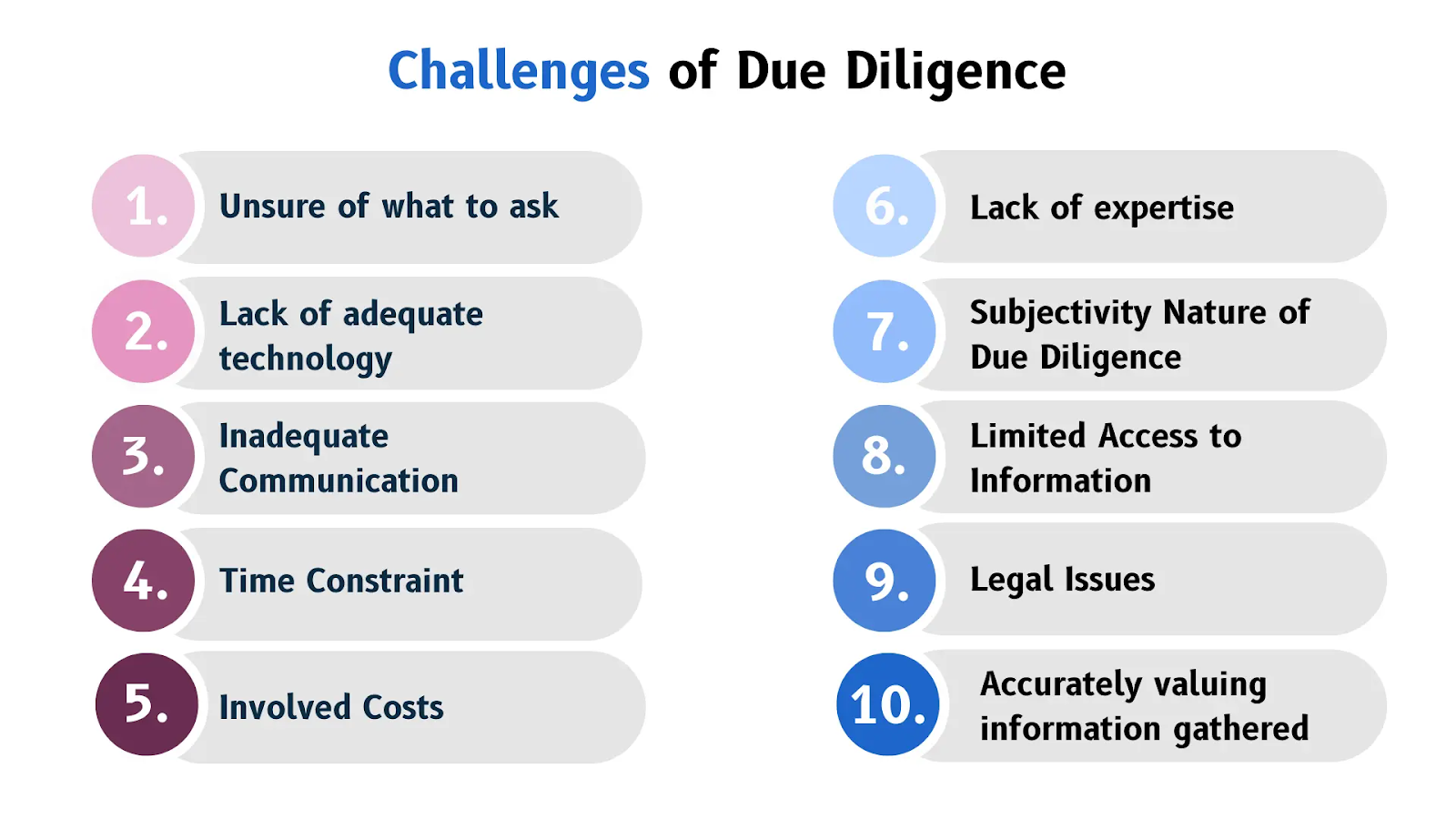

Common Challenges and How to Overcome Them

Challenges in due diligence often stem from too little or too much information. Overcoming these requires establishing clear communication, strategic data collection timing, and leveraging ICT tools for data management. Tools like data mining significantly aid in filtering critical information from vast data sets. Adopting a structured approach and prioritizing essential data collection can further mitigate these challenges.

Legal and Ethical Considerations

In the course of due diligence, the highest legal and moral integrity must be adhered to. It implies that there is a need to observe the necessary laws and adhere to all confidentiality agreements and that the investigation must be conducted with transparency and impartiality. Ethical issues arise with a situation, where one can’t be biased or have a conflict of interest with the observed data and results. Without this important standard being upheld there will be no trust in all parties and there will be no grounds for an investigation that its conclusion is valid and actionable.

The Future of Due Diligence Investigations

Technological advancements, regulatory shifts, and evolving transaction methods are transforming due diligence. Al enhances data analysis, while blockchain increases transaction security. New regulations introduced compliance challenges, necessitating legal scrutiny. As business practices grow more complex, a dynamic, tech-driven due diligence approach is essential to remain effective.

Summary

Due diligence reports are crucial for informed decision-making, requiring expertise and attention to detail, including legal, market, and other factors. As technology evolves and business practices advance, due diligence will continue to expand and adapt. Organizations must prioritize this process, recognizing it as a vital investment for future success.